Below, we have summarized the key takeaways from this panel.

“By applying some of the new AI technology, the leads are being developed or discovered faster. But that is such a small fraction of the time and effort it takes to develop a drug, and there are a lot of areas are right for disruption on the back end as well in manufacturing, regulatory and clinical trials. There are many ways to make advances in BioPharma area, but only by addressing all avenues of the pipeline can really be able to move the needle.”

- Dr. Jennifer Cochran, Shriram Chair of Bioengineering, Stanford University

“BioPharma has always been in the technology industry and is closely related to data. The audience has heard the speakers discuss about data many times, because everything that BioPharma does is about predicting whether certain drugs will be safe and effective for patients.”

- Mary Wheeler, Founder and Managing Director, BioRock Ventures

“China's regulatory environment is getting much better, and its regulatory agencies have begun to use clinical test data from other ICH countries, which has greatly shortened the time for overseas drugs to enter China. Also, China has approved 48 rare disease drugs to enter into the China market without clinical trials. All these policies make it easier for Chinese patients to get access into these high-quality overseas drugs. It may also be a good time for overseas BioPharma companies to enter the Chinese market.”

- Angela Wang (Senior Director of BD, Fountain Medical Development

“If BioPharma development is going after a specific target, as well as is confident of getting a very high and successful response rate, the FDA approval could be very quickly. So some aspects of BioPharma are optimistic, but it means going after specific patient populations with very targeted therapies. ”

- Mike Dybbs, Partner, Samsara BioCapital

1) How do you see that the Biopharma industry has changed over the last few years? How AI has played a role in it?

In order to help inform the conversation and how AI will fit into that, Dr. Cochran decided to lay the landscape for current drug discovery and development process:

Low efficiency: Drugs development is time consuming, with the cost is about $2.6 billion to develop drug from start to finish all the way to FDA approval, which is about 5~10 years on average

High failure rates: 50% of molecules actually will fail in phase three trials. On average, 1 out of 10 drugs will actually make it through the pipeline. And for some disease indications like neuro it's 99.6% failure rate

High cost: there is a thing in drug discovery and development called Eroom's law, which is the reverse of Moore's law. It means drug discovery is becoming slower and more expensive as time goes on

Above are just the realities that people are facing in the healthcare industry. Dr. Cochran added that AI is still in its infancy, but will have a major impact on drug development. Just yesterday, Deep Genomics came out with an announcement that the Company has the first AI discovered drug which is moving forward into the clinic. Although AI has made great progress in the field of BioPharma, it is important to set some realistic expectations:

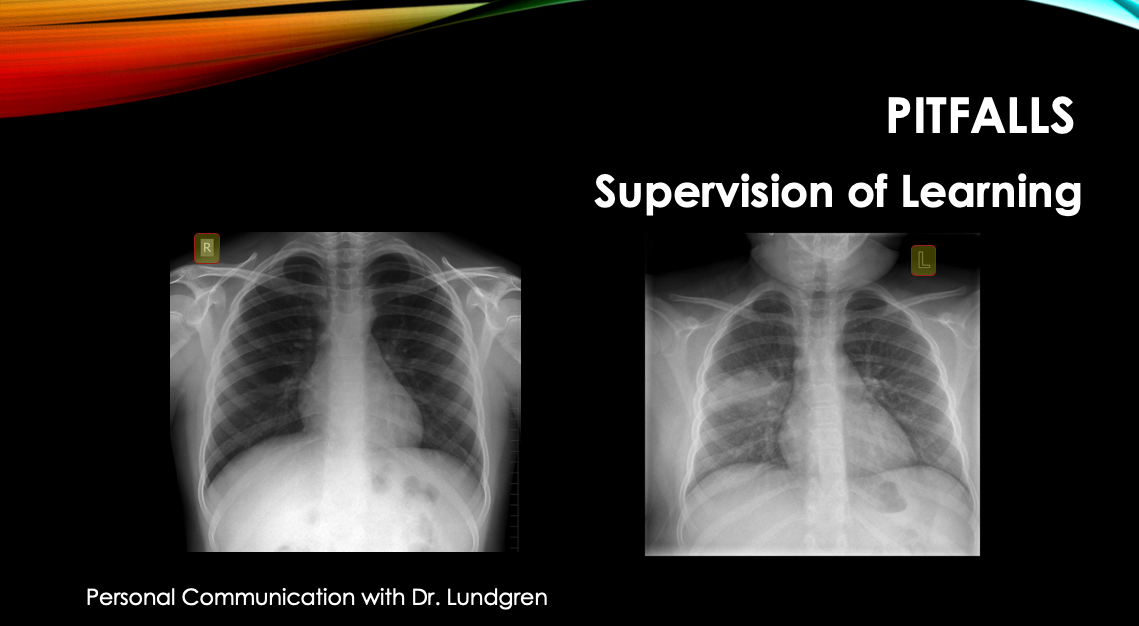

As discussed by previous speakers at the HealthTech Diagnostics panel, AI needs to collect a large amount of quantitative data for analysis

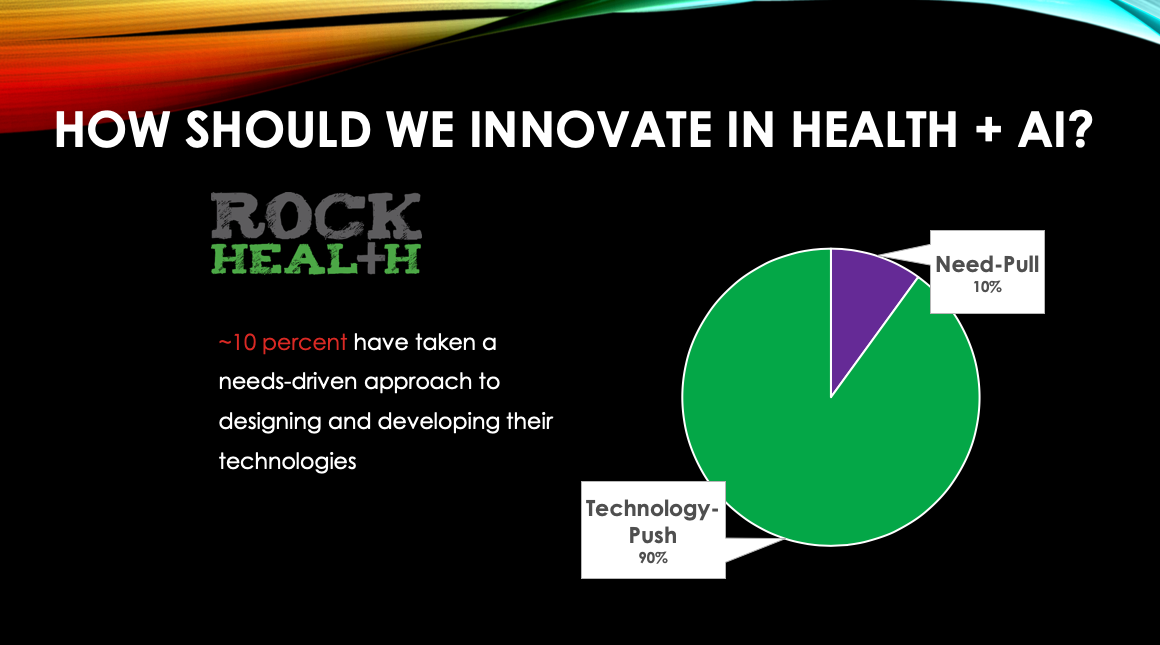

Although AI is being used now for small molecule drug discovery, overall BioPharma has not really accelerated. Because there are other issues such as manufacturing and regulation that need to be addressed, it only shifts the bottleneck

Wheeler answered that BioPharma has always been in the technology industry and is closely related to data. The audience has heard the speakers discuss about data many times, because everything that BioPharma does is about predicting whether certain drugs will be safe and effective for patients. Fundamentally, it would make sense that any new technology would get folded into BioPharma. The content of this industry is related to human health, safety and lives, and it is not necessarily disrupt things like the Food and Drug Administration (FDA).

Dybbs added the following points:

While the stats (high cost and low efficiency) which Dr. Cochran cited are depressing, there are still some glimmers of hope. For targeted therapy going after a kinase inhibitor, the probability of success is actually 50% from beginning to clinical trials to get into the market. The average development time frame is about 10 years, and FDA has approved these types of drugs within 3 years. It shows that if BioPharma development is going after a specific target, as well as is confident of getting a very high and successful response rate, the FDA approval could be very quickly. So some aspects of BioPharma are optimistic, but it means going after specific patient populations with very targeted therapies.

There are huge challenges in terms of data. About 400 drugs have been approved by the FDA over the past 10 years, and perhaps 50k drugs have been used in clinical trials throughout the history of drug development. Since this panel started, Google may have received 100 million search requests. It can be seen that the data sets, especially clinical data, used for BioPharma research and development are tiny for any machine learning approach. In addition to the company, Deep Genomics, Dr. Cochran mentioned earlier, Insilico Medicine had a similar press release this month. These were earlier stage projects where machine learning approaches were valuable in addressing very specific disease indications as well as very specific parts of the drug discovery process, and that's where the most success have been. But, this is also an area where there's been a lot more smoke than fire for decades. In the 90s, there was something called Computer Aided drug design, which was on the cover of Forbes and all these other magazines. This technology is now incorporated in a lot of BioPharma development, but it hasn't changed this industry too much.

Wang stated the current BioPharma has two big trends:

More and more money is getting into CNS disease, because people nowadays live longer, and also needed to live healthier.

Personalized medicine is definitely a big trend.Many companies use genetic markers to screen patients when conducting clinical trials, and some companies focus on utilize AI to screen patients and speed up trial enrollment time.

2) What kind of breakthroughs could make BioPharma easier?

Dybbs answered that the CNS drug development has been the most challenging. It would be great to find a way to interrogate the brain and measure biomarkers in real time. Currently, it is missing a non-invasive way to measure at a molecular level in CNS drug development.

Wheeler agreed that CNS is the toughest, and there is a high unmet need. The human body as a biological system is not created artificially, and AI or other technologies cannot be directly applied like other systems. There is no comprehensive model of organ or any system. Due to the uncertainty in this field, the currently recognized best practice is to allow drug developers to spend 10-20 years and follow specific methods to complete all scientific experiments. Wheeler hopes that some new and better algorithms can be applied to existing human data in the future, so that drug developers can know more quickly whether a drug is effective and safe.

Wang hopes that AI can prevent disease and reduce people's drug dependence. AI is very important for the pharmaceutical industry, especially through the application of big data, but this needs to break all the silos and gather various data sets together.

Dr. Cochran stated that the average for drug discovery is around 18 months. By applying some of the new AI technology, the leads are being developed or discovered faster. But that is such a small fraction of the time and effort it takes to develop a drug, and there are a lot of areas are right for disruption on the back end as well in manufacturing, regulatory and clinical trials. There are many ways to make advances in BioPharma area, but only by addressing all avenues of the pipeline can really be able to move the needle.

3) How does artificial intelligence affect the biopharmaceutical industry? How big is the impact?

Wang shared the following two examples of BioPharma and AI applications:

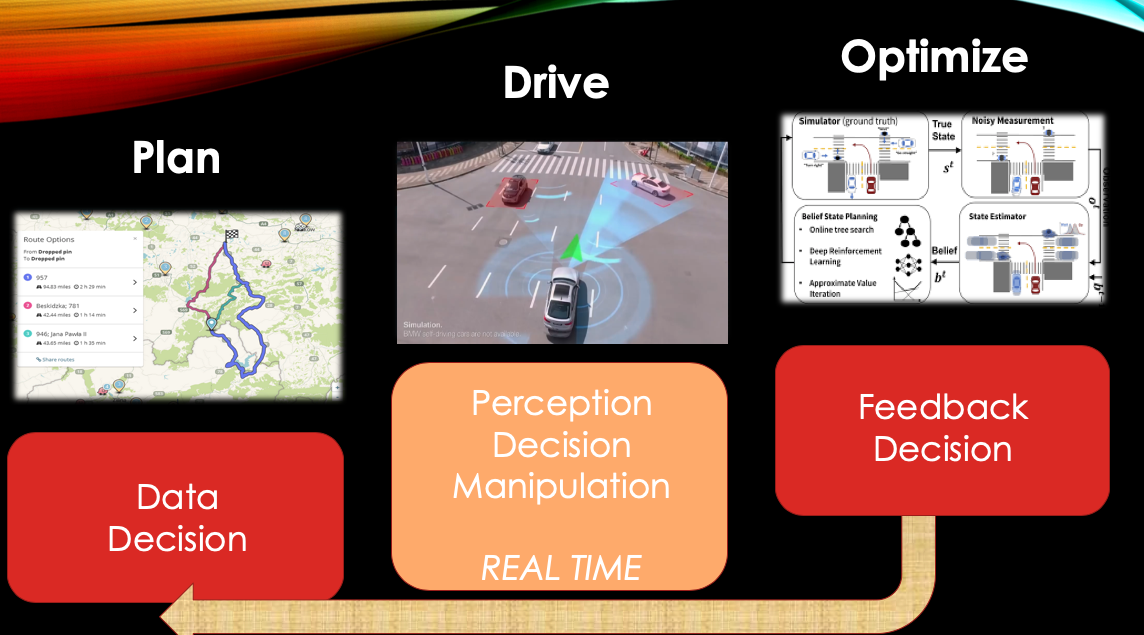

For a clinical trial involving 100 patients, it usually takes 6 months to 1 year for developers to consider all the inclusion and exclusion criteria. But by using AI, developers can quickly determine which patients meet the test requirements, thereby speeding up clinical trial enrollment.

Clinical trial protocol design not only greatly affects the success rate of clinical trials, but also requires a lot of time for highly specialized professionals to complete. Just as in the legal industry, AI is used to generate relevant legal document templates, AI can also be used to generate clinical trial protocol design.

Wheeler stated that a company she had invested in many years ago and exited three years later had some of the profiles of what Dybbs was describing. The company developed an imaging technology that can modeled proteins and other sort of chemical structures to predict interactions, but the technology is not called AI and is only considered one of the many practical and helpful tools. There are many similar examples, so now, Wheeler and her colleagues think about AI as another one of those cool tools.

In addition, Wheeler said she has worked with many companies that incorporate some element of AI and drug discovery. In most cases, these startups did not eventually take the drug all the way to the market, but hand these off to big companies. Such startups need to compare current research data with traditional data and help experts with decades of experience in the traditional pharmaceutical industry understand the new technology. Regardless of how startups leverage AI to successfully develop drugs, the results must be as compelling as anything that was brought forward through traditional biology technology.

Wheeler and many drug developers are open to innovation, and most of them don't expect AI will replace current research and development. Once drug developers understand how and what AI actually predict for curing diseases, they will gradually adopt the technology.

Dybbs added that machine learning is very different from deep learning. For example, deep learning has brought huge changes in translation of texts. But machine learning, the techniques that people have been talking about, can only fix 1% or 2% of the problems. Like many industries out there that have the word AI attached, there are too much hypes, specially in BioPharma.

4) What are you excited about in BioPharma?

Dybbs stated that researchers have conducted 30 years of research on gene therapy and cell therapy, and the first batch of gene and cell therapy has been approved in the last three years. Although the product development cycle is incredibly long relative to the software world, investors are excited about these areas. Because developers can targeted patient populations where they have validation of the biology, and also fast to get into clinical trials where some of the techniques of small molecule drug discovery tend to take a lot longer to develop.

Wheeler answered that many BioPharma companies IPO in 2018. It is really having an impact on patients. After a long R&D cycle, researchers can finally has an impact on patients, which is very exciting. That’s also why researchers are always open to additional innovations.

Right now, AI is not at the top of the pharma excitement list. Wheeler explained that the most promising approach is to have experienced technology industry investors to collaborate with experienced technology industry investors and put tons of resources to do better drug discovery. For example, Insitro, a company founded by Daphne Koller, includes not only well-known technology ventures like Google Ventures and A16Z, but also deeply experienced pharma investors Foreste Capital, Third Rock Ventures, and ARCH Venture. BioPharm is still in the exploratory stage, so it must be provided with resources to deeply explore.

Wang replied that China has a large population and many exciting changes. When any pharmaceutical companies sell drugs for commercial strategy, China is a market that should not be ignored. China joined the ICH (International Organization for the Coordination of Pharmaceutical Technical Requirements) in 2017. Prior to this, any data obtained from clinical trials in China was not recognized by other countries, which means that relevant data cannot be used for FDA approval. After China joined the ICH, pharmaceutical companies that plan to conduct multi-regional clinical trials can consider including China in one of the testing sites. On the other hand, due to China's large population, BioPharma companies that focus on rare disease could have a faster recruitment rate they have in the US. United States.

Wang also pointed out that China's regulatory environment is getting much better, and its regulatory agencies have begun to use clinical test data from other ICH countries, which has greatly shortened the time for overseas drugs to enter China. Also, China has approved 48 rare disease drugs to enter into the China market without clinical trials. All these policies make it easier for Chinese patients to get access into these high-quality overseas drugs. It may also be a good time for overseas BioPharma companies to enter the Chinese market.

After forty minutes of insightful discussion moderated by Solome, the panel opened up to take audience questions. Audience members were eager to ask questions of our panelists and engage them in discussions, helping to provide ideas for further innovation and development in the healthcare industry.

This year’s forum was full of lively dialogue and insightful discussions, many of which, unfortunately, cannot be conveyed here. We will continue publishing articles summarizing and analyzing topics from the forum, as well as reports from other relevant forums from time to time. If you are interested, we invite you to follow us on our social media.